OLED TVS are gaining popularity amid the COVID-19 pandemic as consumers are more willing to pay higher prices for high-quality TVS. Lg Display was the sole supplier of OLED TV panels until Samsung Display shipped its first QD OLED TV panels in November 2021.

LG Electronics is easily the largest OLED TV maker on the market and the largest customer for LG Display's WOLED TV panels. Major TV brands all achieved significant growth in OLED TV shipments in 2021 and are committed to maintaining this momentum in 2022. Increased supply of OLED TV panels from Lg Display and Samsung Display is key for TV brands to achieve their business plans.

Growth rates in OLED TV demand and capacity are expected to continue along similar lines. In the first quarter of this year, Samsung planned to purchase about 1.5 million WOLED panels from Lg Display starting in 2022 (though down from the original 2 million due to production delays and commercial terms negotiations), and is also expected to purchase about 500,000-700,000 QD OLED panels from Samsung Display, which will quickly boost demand. Highlights the need to expand production.

In order to cope with the rapidly declining LCD TV panel prices leading to the flood of low-priced LCD TVS in 2022, OLED TVS must adopt strong pricing strategies in the high-end and large-screen markets to regain growth momentum. All the players in the OLED TV supply chain still want to maintain premium pricing and profit margins

LG Display and Samsung Display will ship 10 million and 1.3 million OLED TV panels in 2022. They have to make important decisions

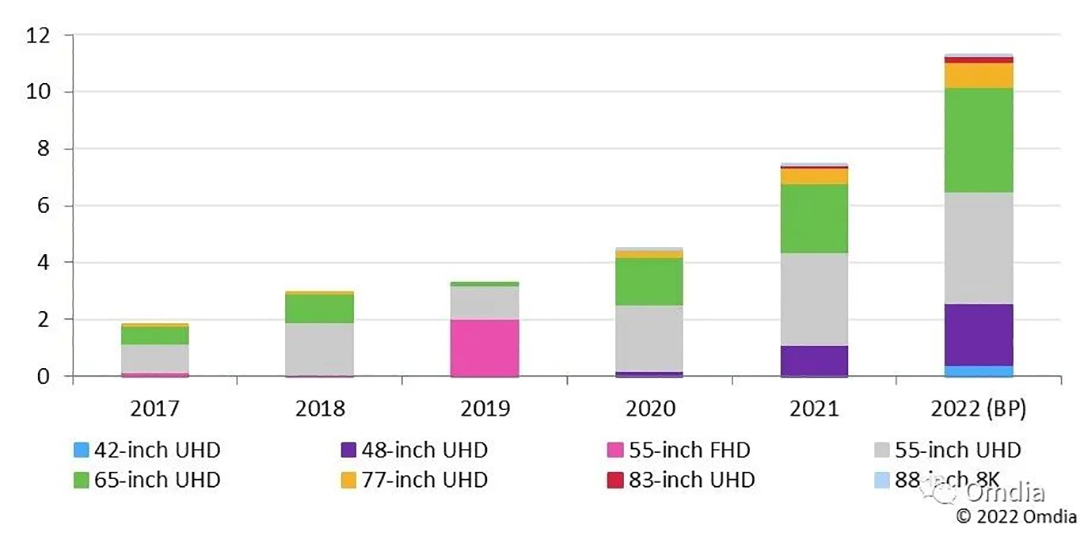

Lg Display shipped about 7.4 million OLED TV panels in 2021, slightly below its forecast of 7.9 million. Omdia expects Lg Display to produce around 10 million OLED TV panels in 2022. This figure also depends on the size specification arrangement lg displays in production.

In the first quarter of this year, it was highly likely that Samsung would launch the OLED TV business in 2022, but it is expected to be delayed from the first half of 2022 to the second half. Lg Display is also expected to ship 10 million units in 2022. Lg Display will soon need to continue investing in OLED TV capacity to ship more than 10 million units in the future.

Lg Display recently announced that IT will invest 15K in E7-1, a six-generation IT OLED plant. Mass production is expected in the first half of 2024. Lg Display has launched a 45-inch OLED display with a 21:9 aspect ratio, followed by 27, 31, 42 and 48-inch OLED esports displays with a 16:9 aspect ratio. Among them, the 27-inch product is most likely to be introduced first.

The mass production of Samsung Display QD panels began in November 2021 with a capacity of 30,000 pieces. But 30,000 units is too little for Samsung to compete in the market. As a result, the two Korean panel makers must consider making important investment decisions on large-size OLED display panels in 2022.

Samsung Display started mass production of QD OLED in November 2021, producing 55 - and 65-inch 4K TV display panels using sleeve cut (MMG).

Samsung Display is currently considering various options for future investment, including 8.5 generation LINE RGB IT OLED investment, OD OLED Phase 2 investment, and QNED investment.

Figure 1: OLED TV Panel Shipments by Size forecast and Business Plan (million units) for 2017 -- 2022, Updated March 2022

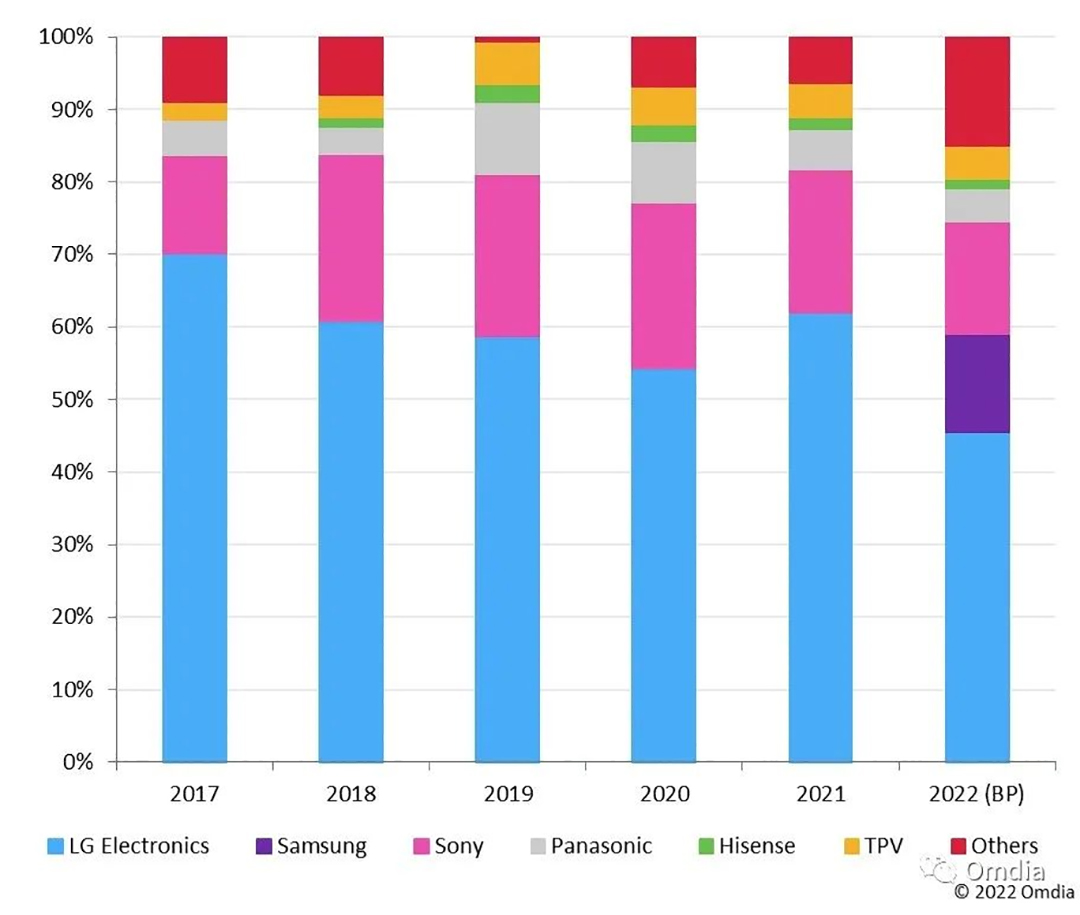

In 2022, 74% of OLED TV panels will be supplied to LG Electronics, SONY and Samsung

While LG Electronics is undoubtedly LG Display's largest customer for WOLED TV panels, LG Display will expand its capacity to sell OLED TV panels to external TV brands that want to maintain its OLED TV shipment targets. However, many of these brands also remain concerned about securing competitive prices and a stable and efficient supply. In order to make WOLED TV panels more competitive in price and serve a wider range of customer needs, Lg Display found a solution to reduce costs by dividing its WOLED TV panels into different quality levels and product specifications in 2022.

In a best-case scenario, Samsung is likely to purchase around 3 million OLED technology panels (WOLED and QD OLED) for its 2022 TV lineup. However, plans to adopt Lg display's WOLED TV panel have been delayed. As a result, its WOLED TV panel purchases ar likely to drop to 1.5 million units or less, in all sizes from 42 to 83 inches.

Lg Display would have preferred to supply WOLED TV panels to Samsung, so it will reduce its supply to customers from TV makers with smaller shipments in the high-end TV segment. Moreover, What Samsung does with its OLED TV lineup will be a dominant factor in the availability of LCD TV display panels in 2022 and beyond.

Figure 2: Share of OLED TV panel shipments by TV brand, 2017 -- 2022, updated in March 2022.

Samsung had originally planned to launch its first OLED TV in 2022, aiming to ship 2.5 million units that year, but that high profile target was lowered to 1.5 million units in the first quarter of this year. This was mainly due to delays in adopting Lg Display's WOLED TV panel, as well as QD OLED TVS launched in March 2022 but limited sales due to limited supply from its panel suppliers. If Samsung's aggressive plans for an OLED TV are successful, the company could become a serious competitor to LG Electronics And SONY, the two leading OLED TV makers. TCL will be the only Top Tier manufacturer not to launch OLED TVS. Although TCL had planned to launch A QD OLED TV, it was difficult to make it happen due to the limited supply of Samsung's QD display panel. In addition, Samsung Display will give preference to Samsung's own TV brands, as well as preferred customers such as SONY.

Source: Omdia

Post time: May-21-2022